43 a general co bond has an 8% coupon

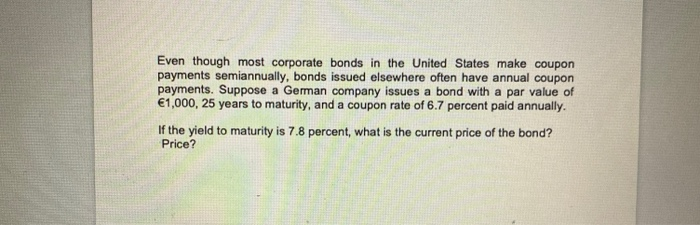

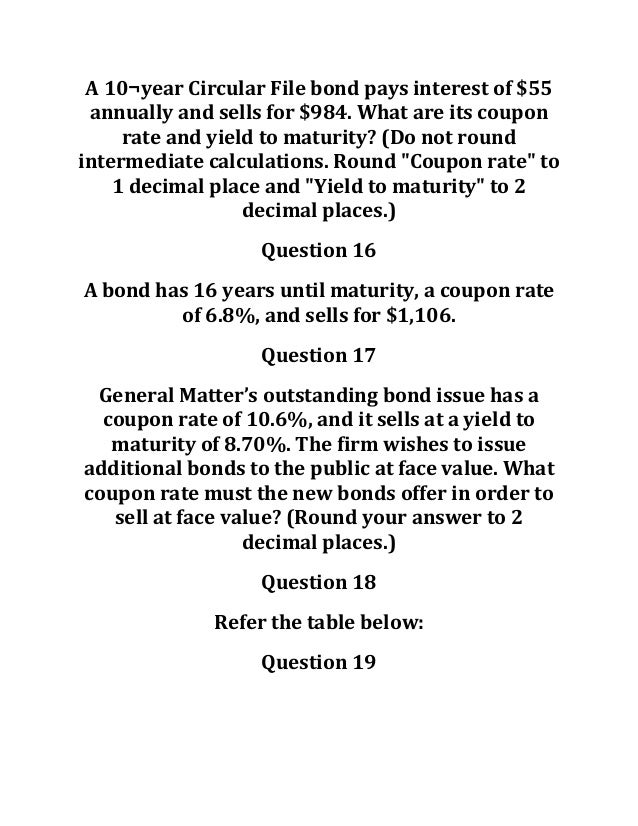

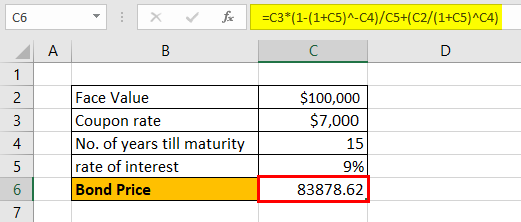

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. Coupon Bond - Investopedia Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This means...

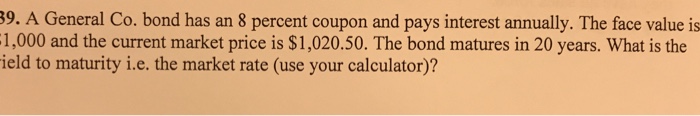

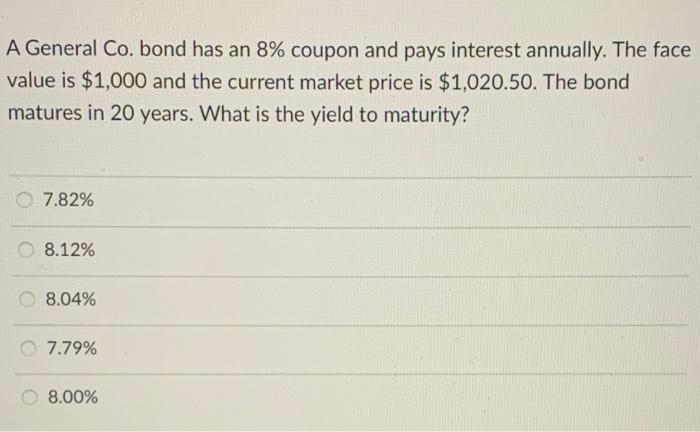

A General Co. bond has an 8% coupon and pays interest annually. The ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity?...

A general co bond has an 8% coupon

Solved A General Co. bond has an 8% coupon and pays interest - Chegg Question: A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity This problem has been solved! You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer A general co bond has an 8 coupon and pays interest A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in20 years. What is the yield to maturity? A. 7.79 % B. 7.82% C. 8.00% D. 8.04% E. 8.12% B. 7.82 % Yield to maturity is the annual rate of return an investor receives if a bond is held to maturity. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ...

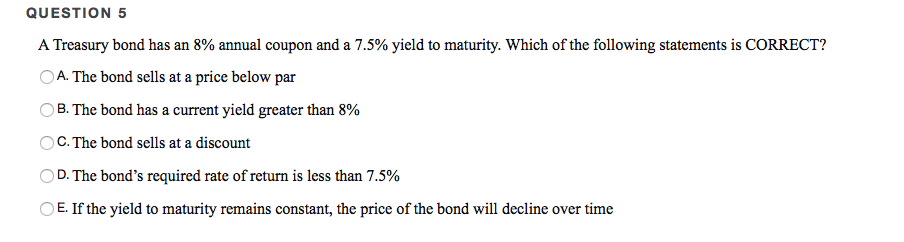

A general co bond has an 8% coupon. FINN 3226 CH. 4 Flashcards | Quizlet A 10-year bond pays an annual coupon, its YTM is 8%, and it currently trades at a premium. Which of the following statements is CORRECT? a. If the yield to maturity remains at 8%, then the bond's price will decline over the next year. b. If the yield to maturity increases, then the bond's price will increase. c. FIN780 Chapter 5.docx - A bond with a 7% coupon that pays... If bond sells at par, the yield to maturity is the coupon rate. A General Co. bond has an 8% coupon and pays interest annually. The face value is $1000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? N = 20 PV = -1,020.50PMT = (1,000x8%) FV = 1,000 CPT I/Y = 7.79% Answered: A five-year bond, $1000 par value, 8%… | bartleby A five-year bond, $1000 par value, 8% yearly coupon paid semi-annually, and now has a 7% annual yield. Write the bond pricing equation in its 5. (1) complete form, (2) summation from, and (3) discount factor form. 4) calculate its current price and its price one year late Question Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ...

Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... CF Chp 8 Flashcards | Quizlet All else constant, a coupon bond that is selling at a premium, must have: A. a coupon rate that is equal to the yield to maturity. B. a market price that is less than par value. C. semi-annual interest payments. D. a yield to maturity that is less than the coupon rate. E. a coupon rate that is less than the yield to maturity Answered: ) A bond has a $11,000 face value, an… | bartleby Question. thumb_up 100%. 16.) A bond has a $11,000 face value, an 8-year maturity, and a 2.75% coupon. Find the total of the interest payments paid to the bondholder. Company A has a bond outstanding that pays an 8% coupon. The... Bond cashflows are Coupon payments and Maturity proceeds Coupon payInent are semi-annual payments. Coupon payment is 2 Face value of bond'Coupon rate* (6/12) Coupon payment is = (1000*8%* (6/12)) Coupon payInent is = $ 40/. Maturity proceeds is $ 1,000].

Answered: A General Power bond carries a coupon… | bartleby A General Power bond carries a coupon rate of 8.5%, has 9 years until maturity, and sells at a yield to maturity of 7.5%. (Assume annual interest payments.) a. What interest payments do bondholders receive each year? b. At what price does the bond sell? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. M12 - exercises.docx - Chapter 12 Problems 1- A bond pays... Chapter 12 Problems 1- A bond pays $80 per year in interest (8% coupon). The bond has 5 years before it matures at which time it will pay $1,000. Assuming a discount rate of 10%, what should be the price of the bond (Review Chapter 3)? Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. Solved A General Co. bond has an 8% coupon and pays | Chegg.com A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity? A. 7.62% B. 7.79% C. 8.24% D. 8.12%. Question: A General Co. bond has an 8% coupon and pays interest semiannually.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia Conversely, if the bond price were to shoot up to $1,250, its yield would decrease to 8% ($100 / $1,250), but again, you would still receive the same $50 semi-annual coupon payments. This is...

Coupon Rate Calculator | Bond Coupon Calculating the coupon rate requires four steps: Determine the face value. The face value is the balloon payment a bond investor will receive when the bond matures. For our example, the face value is $1,000. Calculate the annual coupon payment

FIN Ch. 6 Flashcards | Quizlet a. general credit-worthiness of the issuing company ... If an American Water Company bond has a coupon rate of 9.0 percent and is selling for $920, then the yield to maturity must be: a. greater than 9% ... Baywa has an outstanding bond that has a coupon rate of 8.3%. What is the market price of this bond if it pays interest semi-annually, has ...

Solved A General Co. bond has an 8% coupon and pays interest | Chegg.com A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? 7.82% 8.12% 8.04% 7.79% 8.00% Question: A General Co. bond has an 8% coupon and pays interest annually.

A General Co. bond has an 8% coupon and pays interest semiannually. The ... A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity?...

Answered: Bond A has an 8% annual coupon, Bond B… | bartleby Business Finance Q&A Library Bond A has an 8% annual coupon, Bond B has a 10% annual coupon, and 8ond C has a 12% annual coupon. Each of the bonds has a maturity of 10 years and a yield to maturity of 10%. If market interest rates remain at 10 %, what will happen to the bonds' prices one year from now?

Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Solved A General Co. bond has an 8% coupon and pays interest - Chegg A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? Expert Answer 92% (12 ratings) Yield to Maturity is the internal rate of return of the Bond. It represents the amount of profit or loss on the …

Solved A General Co. bond has an 8 % coupon and pays | Chegg.com A General Co. bond has an 8 % coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? Can I Question like this be solved by Hand, e.g. by extrapolation with a Discount table OR only by Trial and error and with a financial calculator?

A General Co. bond has an 8 % coupon and pays interest annually. A General Co. bond has an 8 % coupon and pays interest annually. The face value is $1,000 and the current market price - Answered by a verified Tutor ... 7.79 % 7.82 % 8.00 % 8.04 % 8.12 %. Submitted: 13 years ago. Category: Homework. Show More. Show Less. Ask Your Own Homework Question. Share this conversation. Answered in 5 minutes by: 6/23/2009.

A 12 year 5 coupon bond pays interest annually the - Course Hero A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? A) 7.79% The bond sells at a premium, so its YTM has to be below 8%.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ...

A general co bond has an 8 coupon and pays interest A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in20 years. What is the yield to maturity? A. 7.79 % B. 7.82% C. 8.00% D. 8.04% E. 8.12% B. 7.82 % Yield to maturity is the annual rate of return an investor receives if a bond is held to maturity.

Solved A General Co. bond has an 8% coupon and pays interest - Chegg Question: A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity This problem has been solved! You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "43 a general co bond has an 8% coupon"