44 us treasury bonds coupon rate

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.719% yield. 10 Years vs 2 Years bond spread is -39.9 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.25% (last modification in September 2022). The United States credit rating is AA+, according to Standard & Poor's agency. How does the U.S. Treasury decide what coupon rate to offer on Treasury ... How do you calculate the 10-year U.S. Treasury note futures contract price from the interest rate of a 10-Year U.S. Treasury note ? At a 6% yield, that 2.37% coupon note would be worth $0.7300 per $1 face. If you deliver $100,000 face of this note into the contract, you will be paid the futures price times the conversion factor times $1,000.

U.S. Treasury Bond Futures Quotes - CME Group US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. ... Index (CVOL TM), a robust measure of 30-day implied volatility derived from deeply liquid options on 30-Year U.S. Treasury Bond ...

Us treasury bonds coupon rate

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis. Front page | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. ... Savings Bonds - Treasury Securities. ... Treasury Interest Rate Statistics . The Basics Of Bonds - Investopedia Jul 31, 2022 · Bonds (T-bonds) issued by the Treasury with a year or less to maturity are called “Bills”; bonds issued with 1 to 10 years to maturity are called “notes”; and bonds issued with more than ...

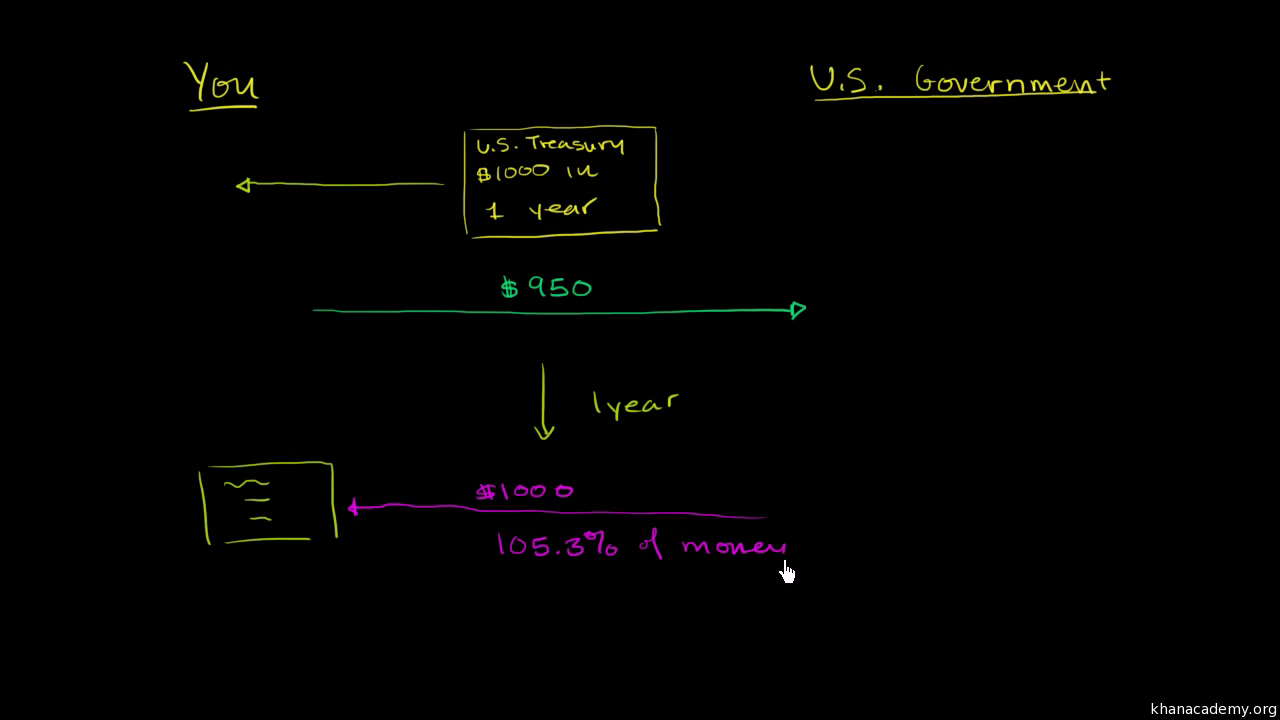

Us treasury bonds coupon rate. Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so... How Often do Treasury Bonds Pay Interest? | Fox Business A 30-year U.S. Treasury bond falls into that category. The most recently issued 30-year bond has a 2.75% coupon. The coupon rate determines the interest payments. The 2.75% is the annual coupon ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Some municipal bonds are exempt from income taxes, which boost their equivalent yield when compared against other bonds. Other Treasury Marketable Securities. Investors can also purchase inflation-protected Treasury securites (TIPS), US Treasury floating rate notes (FRN), as well as Treasury Strips. Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. How Is the Interest Rate on a Treasury Bond Determined? - Investopedia Instead, a set percent of the face value of the bond is paid out at periodic intervals. This is known as the coupon rate. 2 For example, a $10,000 T-bond with a 5% coupon will pay out $500... Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

TMUBMUSD03Y | U.S. 3 Year Treasury Note Overview | MarketWatch Coupon Rate 3.500% Maturity Sep 15, 2025 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch Treasury yields head lower across the curve, led by drop in 2- and 3-year rates,... Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon . Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity. Treasury Bonds | AOFM With ex-interest Treasury Bonds the next coupon payment is not payable to a purchaser of the bonds. In this case, calculation of an ex-interest price is effected by the removal of the '\( 1 \)' from the term: ... the half-yearly rate of coupon payment per $100 face value. \(\large n=\) the term in half years from the next interest payment date ...

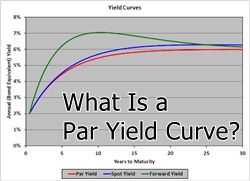

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

Press Releases | U.S. Department of the Treasury California to Receive up to $1.1 Billion from U.S. Treasury Department to Promote Small Business Growth and Entrepreneurship through the American Rescue Plan September 20, 2022 Readouts READOUT: Secretary of the Treasury Janet L. Yellen’s Meeting with the National Association of Manufacturers’ Board of Directors

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch TMUBMUSD01Y | A complete U.S. 1 Year Treasury Bill bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate - Forbes With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an...

US Treasury Zero-Coupon Yield Curve - NASDAQ Refreshed 14 hours ago, on 21 Sep 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

How to Buy Treasury Bonds: Prices & Options for Beginners The minimum requirement for buying a Treasury is usually $100 and goes up from there in increments of $100. While a typical lot size for Treasuries is either $100,000 or $1 million, you can, of ...

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Individual - Series I Savings Bonds - TreasuryDirect Rates & Terms. I bonds have an annual interest rate derived from a fixed rate and a semiannual inflation rate. Interest, if any, is added to the bond monthly and is paid when you cash the bond. I bonds are sold at face value; i.e., you pay $50 for a $50 bond. More about I bond rates; Redemption Information. Minimum term of ownership: 1 year

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Coupon 3.00%; Maturity 2052-08-15 ... ALL CNBC INVESTING CLUB PRO. Bond yields rise, 2-year Treasury breaks 3.8% on higher Fed hike expectations September 15, 2022 CNBC.com. ... Advertise With Us ...

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

Bonds Center - Bonds quotes, news, screeners and educational ... - Yahoo! US Treasury Bonds Rates. Symbol. Name Last Price Change % Change 52 Week Range Day Chart ^IRX. 13 Week Treasury Bill: 3.1900: 0.0000: 0.00% ^FVX. Treasury Yield 5 Years: 3.7130: 0.0000: 0.00% ^TNX.

Treasury Bills vs Bonds | Top 5 Best Differences (With ... Treasury bills are issued at a discounted price whereas Treasury Bonds pay interest every six months to holders of a bond. Treasury bills mature in a year or less whereas Treasury bonds have a maturity greater than 10 years. Return on investment is low in Treasury bills instruments due to shorter maturity period ahead return on investment is ...

Solved The yield of the 10-year US Treasury bond is 1.20% ... - Chegg The yield of the 10-year US Treasury bond is 1.20%. It is the risk-free rate. You work for investment manager and your boss asks you to calculate the price of a 10-year corporate bond that yields 3.00% more than its risk-free rate and has a face value of $1,000. The fixed coupon of this corporate bond is 5.00%.

The Basics Of Bonds - Investopedia Jul 31, 2022 · Bonds (T-bonds) issued by the Treasury with a year or less to maturity are called “Bills”; bonds issued with 1 to 10 years to maturity are called “notes”; and bonds issued with more than ...

Front page | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. ... Savings Bonds - Treasury Securities. ... Treasury Interest Rate Statistics .

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis.

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

Post a Comment for "44 us treasury bonds coupon rate"