41 how to calculate coupon rate from yield

Bond Yield Formula | Step by Step Calculation & Examples Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875% Coupon Rate Formula - WallStreetMojo The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

Coupon Rate - Meaning, Example, Types | Yield to Maturity ... Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is 5-year Treasury Yield and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05%

How to calculate coupon rate from yield

Effective Yield - Overview, Formula, Example, and Bond ... Effective Yield = [1 + (i/n)] n - 1 Where: i - The nominal interest rate on the bond n - The number of coupon payments received in each year Practical Example Assume that you purchase a bond with a nominal coupon rate of 7%. Coupon payments are received, as is common with many bonds, twice a year. CEY -- Coupon Equivalent Yield -- Definition & Example The coupon equivalent yield helps the investor calculate exactly what that improved return is or would have been. However, it is important to note that the formula assumes the investor can reinvest those interest payments at a rate equal to the bond 's coupon rate. Bond Yield Calculator - Compute the Current Yield The current yield of a bond is the annual payout of a bond divided by its current trading price. That is, you sum up all coupon payments over one year and divide by what a bond is paying today. Bond Current Yield vs. Yield to Maturity

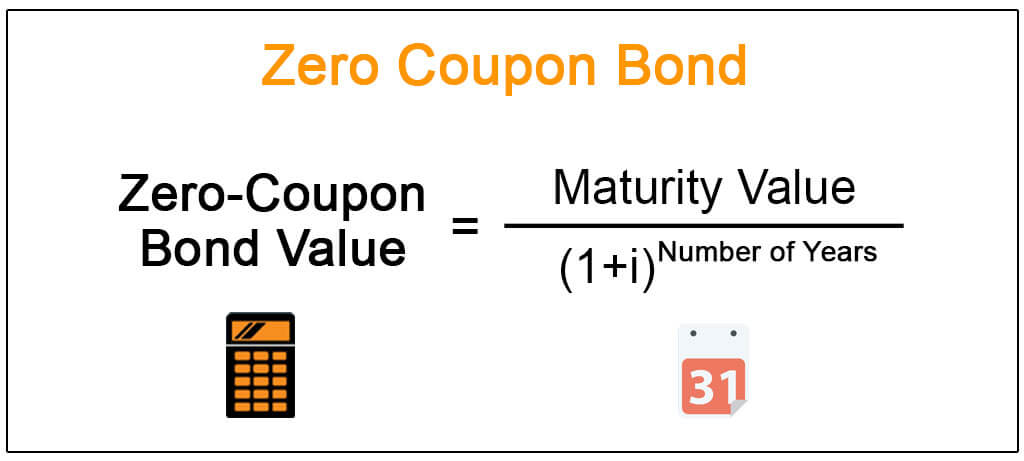

How to calculate coupon rate from yield. Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for... Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Formula | Simple-Accounting.org May 12, 2020 · A bond’s coupon rate can be calculated by dividing the sum of the security’s annual coupon payments and dividing them by the bond’s par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. Understanding Coupon Rate and Yield to Maturity of Bonds ... When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the coupon rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and coupon rate is 2.375%.

Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. How to Calculate Current Yield (Formula and Examples ... Individual bonds pay a fixed sum of money, also called a coupon or nominal yield, each year. You can typically find this as a percentage of the bond's face value or a coupon rate. The formula for coupon rate is: Coupon rate = (total annual coupon payment / par value of bond) x 100 Bond Yield: Definition & Calculation with Interest Rates ... For example, a $1,000-face value bond having a coupon rate of 5% might be trading at $1,040, so its current yield would be: .05/1,040.00 = 4.8%The next day, that same bond might be trading at ... How to Calculate the Yield of a Zero Coupon Bond Using ... So let's go ahead and start plugging in so we see here we have (1 + the forward rate) from year 1 so that's 7% so that's same as 0.07 so we'd have ( 1 + 0.07) is going to be that first term. So We have 1.07. So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%.

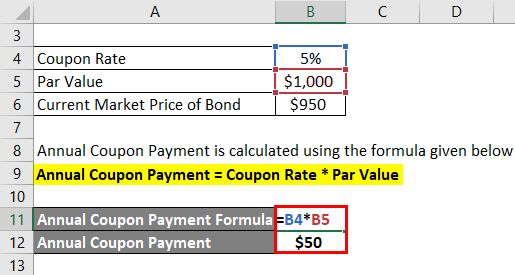

How Can I Calculate a Bond's Coupon Rate in Excel? Jul 19, 2021 · In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a... Coupon Rate Formula | Calculator (Excel Template) Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value ... Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Coupon Rate and Yield to Maturity | How to Calculate ... The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

How to Calculate Coupon Rates - sapling To calculate bond coupon rates, use the formula C = i/P, where "C" represents the coupon rate, "i" represents the annualized interest rate and "P" represents the par value, which is the principal amount (or face value) of the bond. The coupon rate is based on a bond's face value, not current yield.

What Is Coupon Rate and How Do You Calculate It? Dec 03, 2019 · Coupon and yield rates are: Coupon Rate: 10%. This does not change. Investor A Yield Rate: 9%. The investor paid $1,100 for a bond that returns only $100 per year, making their yield on the bond lower than its coupon rate. Investor B Yield Rate: 11%. The investor got a good deal on this bond, collecting $100 per year in exchange for a $900 ...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

Discount Yield - Overview, How To Calculate, Usage Discount yield is the expected annual percentage rate of return earned on a bond when it is sold at a discount on its face value. It is also popularly referred to as the bank discount yield (BDY). Discount yield is commonly calculated for municipal bonds, Treasury bills (T-bills), zero-coupon bonds, commercial paper, most money market ...

A company's balance sheets show a total of $27 million ... A company's balance sheets show a total of $27 million long-term debt with a coupon rate of 12 percent. The yield to maturity on this debt is 8.30 percent, and the debt has a total current market value of $32 million. The balance sheets also show that that the company has 10 million shares of stock; the total of common stock and retained ...

What Is Coupon Rate and How Do You Calculate It? ⋆ ... A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond with a coupon rate of 6% pays ...

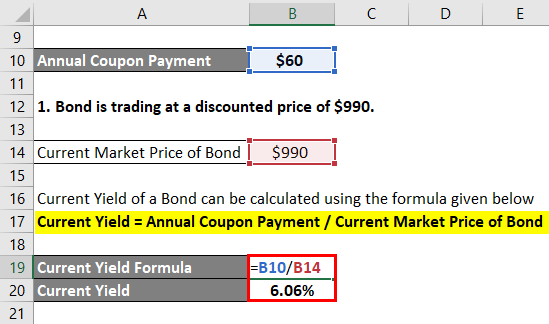

Current Yield Formula | Calculator (Examples with Excel ... Current Yield of a Bond can be calculated using the formula given below Current Yield = Annual Coupon Payment / Current Market Price of Bond Current Yield = $60 / $1,010 Current Yield = 5.94% Therefore, the current yield of the bond is 5.94%. Current Yield Formula - Example #3

Bond Yield Calculator - Compute the Current Yield The current yield of a bond is the annual payout of a bond divided by its current trading price. That is, you sum up all coupon payments over one year and divide by what a bond is paying today. Bond Current Yield vs. Yield to Maturity

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "41 how to calculate coupon rate from yield"